From Spreads To Fees: Simple, transparent, and cheap pricing for Bitcoiners

Introducing changes to our pricing and tiered fees

Jack Mallers

Feb 12, 2024

Yo! Today I’m thrilled to announce Strike’s move from spread-based pricing to fee-based pricing for buying and selling bitcoin. At Strike, we are committed to transparency and pumped about this move. This change, driven by your feedback, ensures you know exactly what costs you’re incurring when buying bitcoin while remaining one of the cheapest and best places to buy bitcoin in the world.

Tomorrow (February 13th), we will begin rolling out our new tiered fee pricing. Our tiered fees are based on how much monthly trading volume a given user does on our platform. The more bitcoin you buy or sell, the cheaper your fees. No, Strike has not gotten more expensive. If anything, it’s the opposite. Most importantly, we have moved our bitcoin pricing to be transaction-fee-based and upfront based on feedback we received from you.

Simple and transparent pricing that gets cheaper the more you Bitcoin. That’s Strike.

The Story

Strike is a business. At the end of the day, to pay the bills and continue building Bitcoin products for our customers worldwide, we need to make money.

To understand Strike as a business from the highest level possible, we help our customers:

- Get into Bitcoin

- Exchange Bitcoin and other currencies

- Use Bitcoin

We help customers buy bitcoin, sell bitcoin, store bitcoin, move bitcoin, use bitcoin for payments, power businesses’ Bitcoin infrastructure, and so on. You know, Bitcoin. We want to be the best in the world at Bitcoin and extend all that it has to offer to humanity for the centuries to come.

One of our biggest business lines is exchanging bitcoin with fiat (BTC/USD, and soon BTC/EUR, BTC/GBP, etc 😁). Historically, one of the ways we have monetized this business line has been with what is called a “spread.” A spread refers to the difference or gap between two prices in finance. For Strike, we had been earning revenue from a part of the spread between the buy (bid) and sell (ask) prices for bitcoin.

In July 2021, I introduced this idea when Strike started offering the ability to buy and sell bitcoin on the app. Since then, spreads on Strike for bitcoin trading have typically ranged anywhere from 0.1%-1%+ depending on a slew of variables like market conditions, the size of the order, the use case, and more. As of last week, the “typical” all-in spread seen by customers was around 0.93%, with approximately 0.8% from us and 0.13% from the market makers.

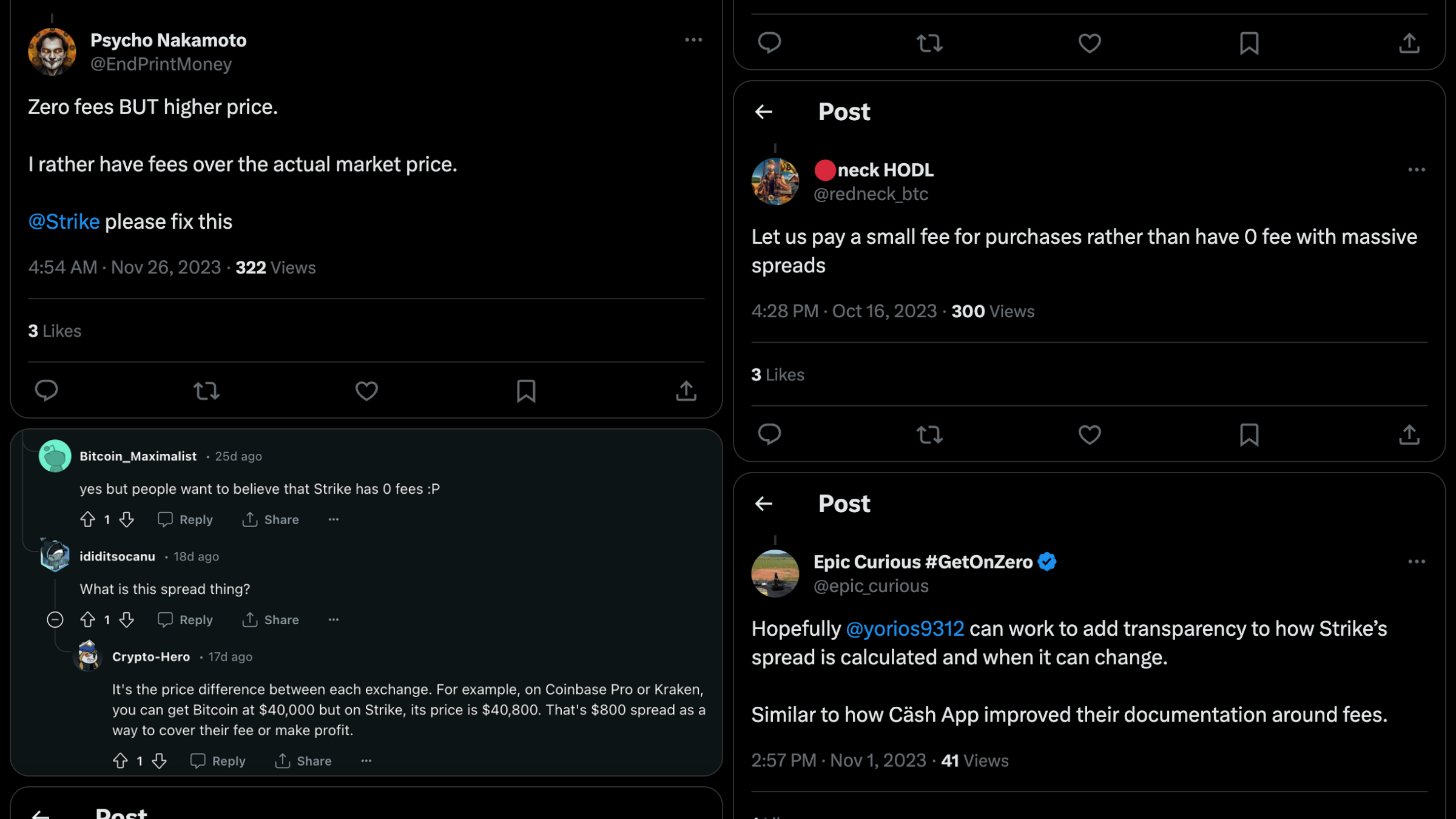

As Strike has matured, we’ve gotten a lot of feedback from you all. The consensus? Many of you don’t like the spread-based model. Not transparent enough and isn’t as easy to understand.

I actually kept a folder of your feedback:

Not only have I heard you loud and clear, I agree. We are always looking to be more transparent when it comes to pricing, and tiered-fees makes this as simple and clear as possible.

It shouldn’t be rocket science to understand the cost of buying bitcoin from us. Shoutout to Crypto-hero on Reddit but we shouldn't need our customers to explain how our pricing works in Reddit threads. So fix it we shall, @EndPrintMoney.

So, we got to work. We tinkered, we researched, we spoke to many of you, and we started building. We took this opportunity to truly understand you, our customer, and build a better pricing model for Bitcoiners. Not only did we go from spreads to fees for buying and selling bitcoin, but we went further; we built a brand new tiered fee structure that gets cheaper the more you use Strike to buy or sell bitcoin.

Today, we bring that proof-of-work to you. I’m happy to finally introduce our new tiered-fee pricing for US customers. I’m happy to sunset our spread when it comes to buying or selling bitcoin. I’m happy to give you upfront fees. I’m happy to give you more sats the more you Bitcoin on Strike. I’m happy, and we think you are going to be happy too.

Simple and transparent pricing that gets cheaper the more you Bitcoin. That’s Strike.

Built by Bitcoiners, for Bitcoiners.

Strike’s New Tiered Fees Pricing Structure

Ok Jack, so what are the fees? How does this work? What in the world is a “tiered fee”?

Can you explain what’s going on?

Yes. Yes, I can.

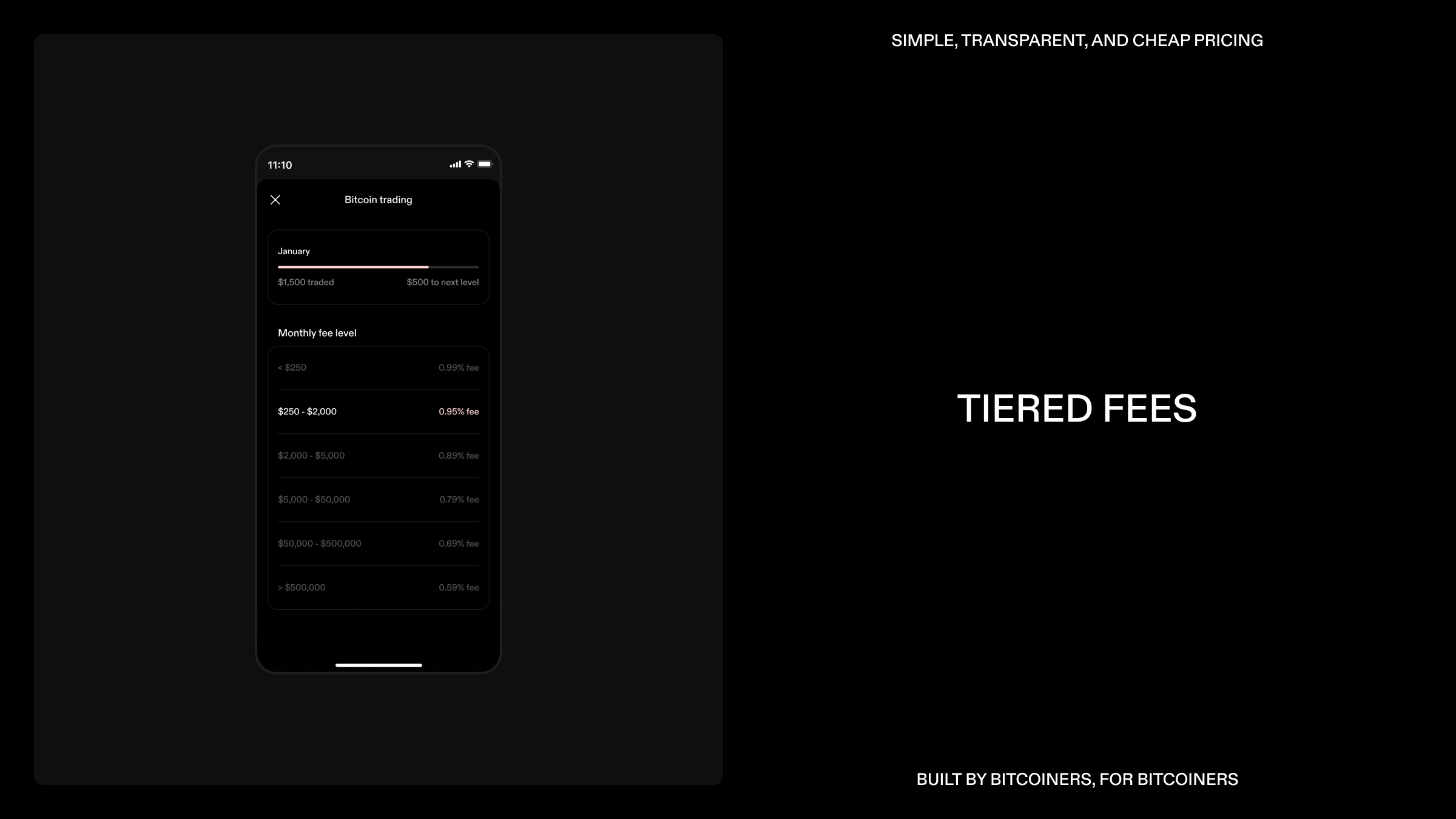

Strike’s Tiered Fees — The What

Our tiered fees are fees that are based on how much monthly trading volume you do on Strike. The more volume you do on Strike, the cheaper the fees.

First things first, if we are going to give you cheaper fees based on volume, what counts as volume? The below is what we are currently accounting for when tallying up your trading volume activity on Strike:

- Buys

- Sells

- DCAs

- Direct deposit auto-conversions (Getting paid in Bitcoin)

The more you buy, sell, DCA, and get paid in bitcoin the more valuable Strike gets for you!

Ok, next very logical question: What are the tiers? For launch, we have the following tiers:

- Less than $250 per month

- $250 to less than $2,000 per month

- $2,000 to less than $5,000 per month

- $5,000 to less than $50,000 per month

- $50,000 to less than $500,000 per month

- Over $500,000 per month

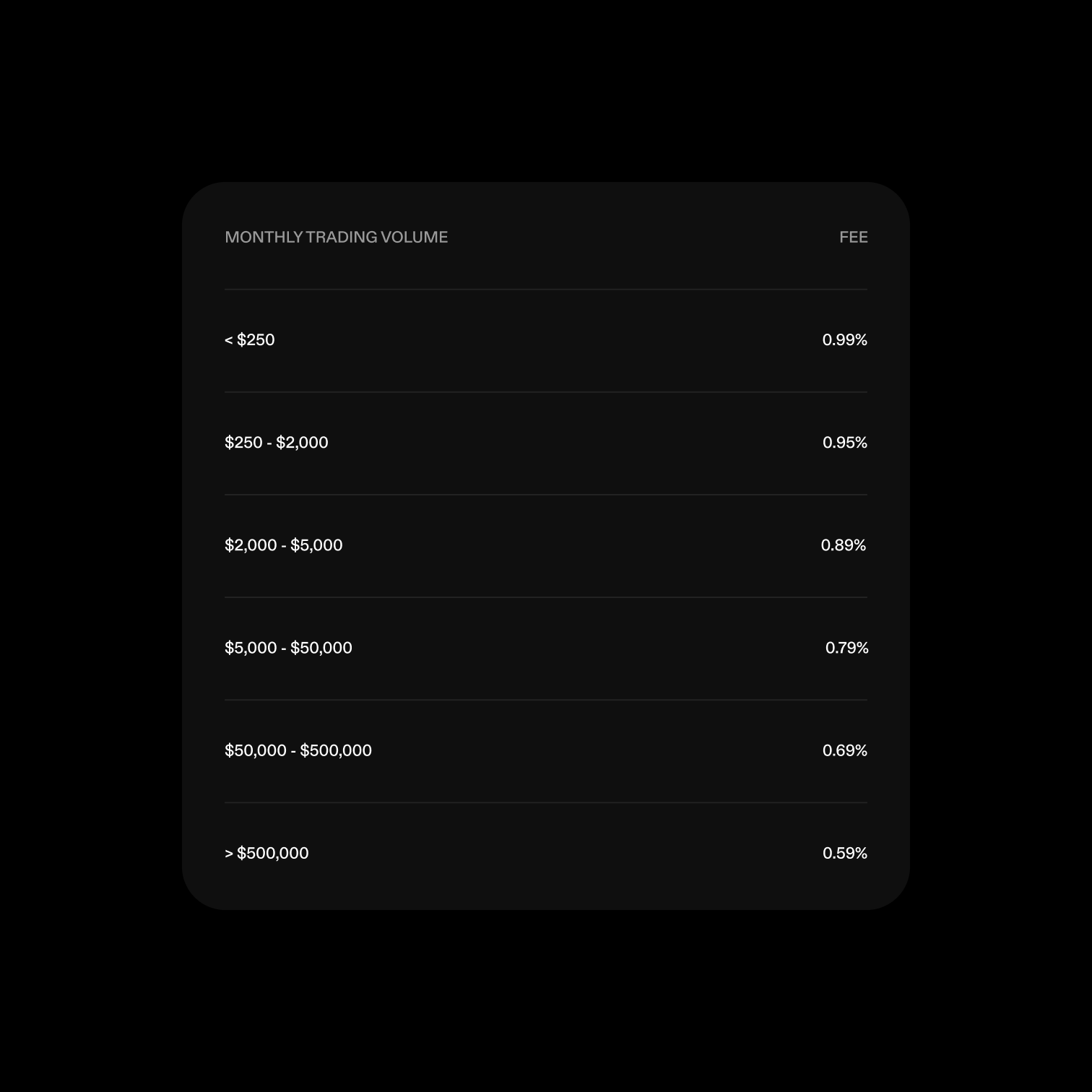

Lastly, and most importantly, what are the fees for each tier? Ladies and gentlemen, I present to you, our new tiered-fee pricing:

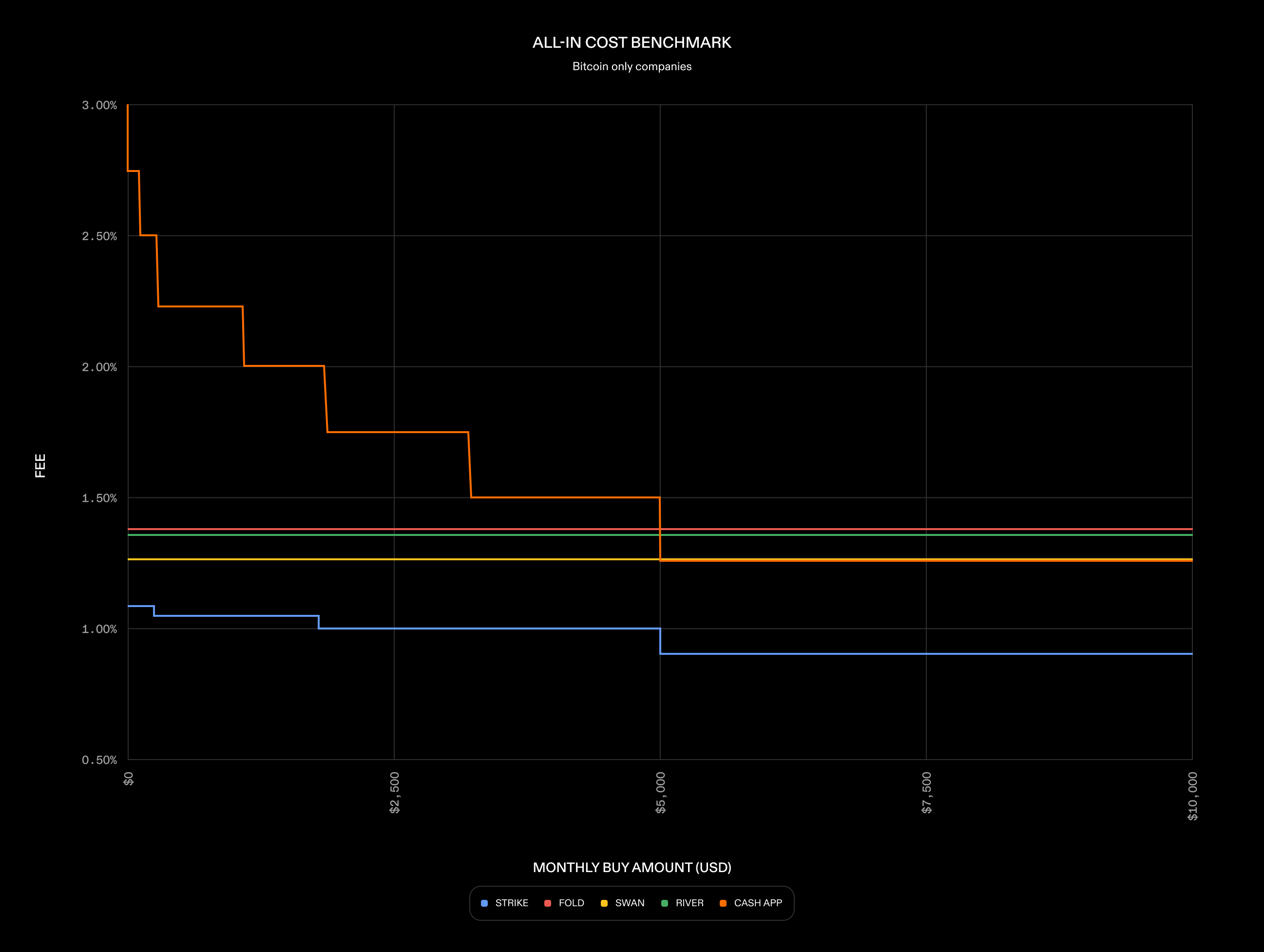

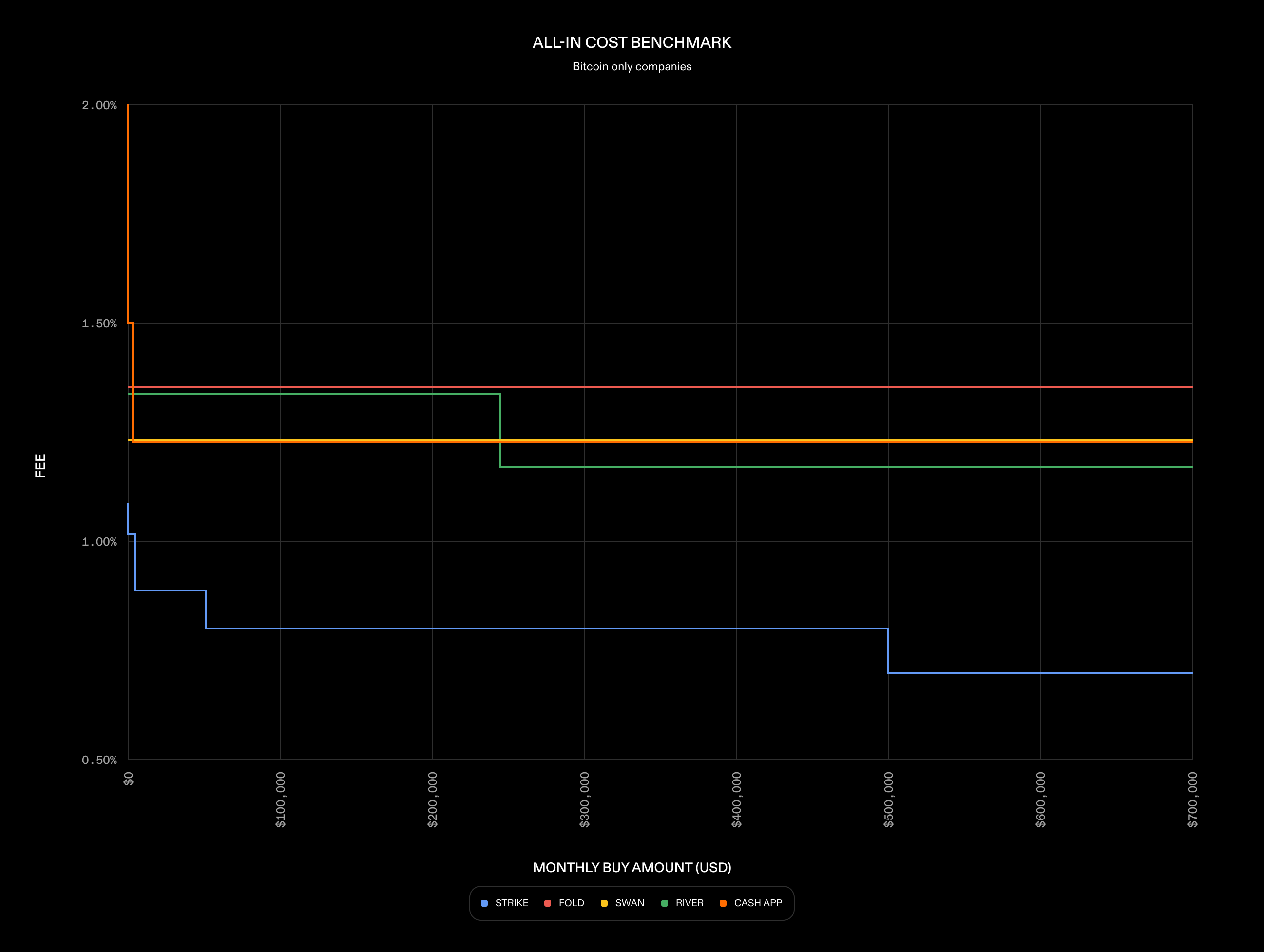

Is This A Cheap Way To Buy Bitcoin? How Cheap Is Strike Compared To The Market?

Now that we’ve walked through the tiered fees, some of you may be wondering, is Strike no longer a cheap place to buy bitcoin? Did Strike just get overall more expensive with this move?

No, we did not.

To help show this, we gathered some data on how Strike compares to the rest of the market. I see a lot of FUD out there on pricing in Bitcoin. It’s not all specific to Strike, but Strike has definitely caught some pricing FUD. It’s not the biggest deal in the world, but as long as I was writing this blog, I figured I’d put some visuals together to illustrate how competitive our pricing is relative to the market.

Before I share, a quick disclaimer: First of all, it is very complicated (if not impossible) to build one visual, one website, one dashboard, etc. for competitive analysis because some companies offer incentives on DCA, Direct Deposit and so on. It's not an apples to apples comparison. This is not the Bible.

However, what these visuals do show is that Strike is an incredible place to buy bitcoin, especially if you’re doing more than a couple hundred bucks. We give you a lot of sats for your fiat and stair-step our way down in fees the more you Bitcoin with us in cumulative monthly volume, which is super unique to Strike.

We care a lot about offering you the most sats we possibly can. It’s not easy. If it were, everyone would do it, ya know?

So, for the curious, here are a few visuals to show you where we stand on the other side of this change.

Smaller volumes: $0-$10,000

Larger volumes: $0-$1,000,000

A few more notes and disclaimers. Just trying to showcase our pricing, not trying to contribute more FUD:

- “All-in cost” means estimated spread (measured from midpoint between bid and ask price) plus transaction fees as a percentage of the purchase amount.

- Fee rates for other companies are sourced from company websites, and estimated spreads are sourced from btcpricetool.com. Changes to the all-in-cost for Strike will begin rolling out tomorrow.

- The Strike USD amount is the cumulative monthly buy amount. Other company USD amounts are single-purchase amounts.

- The graph does not show subscription rates, recurring purchase (DCA) rates, or direct deposit rates.

- Fold trading costs are for the free Spin plan, not the subscription-based Spin+ plan.

- Cash App trading costs are for single bitcoin trades. Lower fee rates and spreads may be available for direct deposited funds.

- River trading costs are for single bitcoin trades. Lower fee rates and spreads may be available for DCA.

- These charts do not include incentives such as cashback and referral rewards.

- Lowest-tiered River fee rates of 0.9% between $1,000,000.01 and $5,000,000 and 0.8% above $5000,000 not shown on charts due to scale.

- This is based on data from February 2024.

Look at that, pretty awesome! Strike is as competitive as it gets, especially if you’re more than a casual Bitcoiner. I also personally love the tiered pricing based on cumulative volume, not on a per-order basis. If you stack a portion of your paycheck and DCA that should absolutely count towards the discount we give you when you smash buy some bitcoin.

Anyways, now that we have covered the what of our new tiered-fees pricing, let’s discuss the why.

Strike’s Tiered Fees — The Why

What thought and consideration went into these changes? Glad you asked.

When considering all of the feedback from the community and thinking about the dream fee structure for Bitcoiners, we set out to accomplish three main things:

- Be As Transparent As Possible. Our customers want transparency. Bitcoin bleeds transparency. It is critical for our mission, our business, and Bitcoin that we lead with ultimate transparency. We want everyone to know exactly how much fees are, why they are what they are, and how we make money as a business.

- Be One Of The Cheapest. We want to be one of the cheapest in the world to do Bitcoin well. We want to align with the Bitcoiner, always. As a company, we believe we have an advantage as a younger, lean, Bitcoin-focused business. We don’t need to support millions of employees, we don’t need to listen to the fiat public markets, we don’t need to support shitcoins, and we don’t need to afford one thousand other products. We only need to support doing Bitcoin the best for you. This allows us to be able to charge less than the rest of the market, which we see as a huge advantage for us and an opportunity to drive a lot of value to our customers. When using Strike, we want our customers to get more bang (sats) for their bucks (fiat).

- Build Incentives For Bitcoiners. Strike is a Bitcoin-only company built for Bitcoiners. We’ve realized the Bitcoiner journey goes from curious to fully orange pilled over time, so that’s how we’ve designed our fees. The more you become a Bitcoiner, and the more volume you do, the cheaper and more valuable Strike is to you.

Boom! We’ve realized everyone embarks on a similar journey in Bitcoin. You hear about Bitcoin, it piques your interest, you fall down the rabbit hole, and before you know it you take every excess dollar you have and stack sats. Like clockwork. Maybe you aren’t a Bitcoiner immediately, but everyone becomes a Bitcoin eventually. With Strike, we want to be aligned with that journey. We want to help our customers from hearing about Bitcoin to living on bitcoin. We do media appearances, we have the Money Matters podcast, we have Strike Learn, and we have all of the infrastructure, licenses, software, products, and now pricing to support you and that journey.

The more you become a Bitcoiner, the more volume you do, and the more you care about the amount of sats you stack. Paying Coinbase hundreds of basis points quickly becomes outrageous.

The more you become a Bitcoiner the more you care about transparency, morals, ethics, principles, and the mission. You want a company you can trust and want to support building into the future.

The more you become a Bitcoiner, the more valuable Strike is to you. That’s the big strategic design with our new pricing model. We wanted our pricing to reflect the journey our customers go down. As you do more Bitcoin, Strike becomes cheaper, and Strike is more valuable to you.

Thanks

As I mentioned, Strike is a business, and we would be nothing without our customers. Thank you all so much for doing your Bitcoin activity with Strike. We're really proud of this change. We heard you loud and clear, we researched, spent time with you all, and thought deeply about what a geat pricing model would be for Bitcoiners. Clear, transparent, cheap, and incentivized with the journey we and our loved ones all go down.

As a reminder, this change will rollout over the next week for US customers. Some of you will get it tomorrow, some of you will get it in the coming days. If you ever have any issues, please reach out to us on Twitter or via Support, we're here to help.

Thanks again for all of the continued support. This is one of three things we plan on launching this month in February. As of writing, next week we have a new region Strike is entering, and after that our brand new limits system. LFG!

Talk to you then. Much love.

Jack

© 2025 NMLS ID 1902919 (Zap Solutions, Inc.)