Announcing Bitcoin-Backed Loans

Borrow against your bitcoin without selling, with fast, flexible loans at market-leading terms

Jack Mallers

May 06, 2025

Yo! Today we’re announcing one of the most powerful features we’ve ever built at Strike: bitcoin-backed loans.

For the first time, eligible customers can borrow against their bitcoin without selling. Get access to cash using your bitcoin as collateral with fast, flexible loans at market-leading terms. Whether you’re buying a home, investing in your business, or funding your next move, bitcoin-backed loans let you tap into your wealth without giving up your stack.

Borrow between $75,000 and $2,000,000 for up to 12 months, starting at 12% APR with a 0% origination fee, available now in select U.S. states.

Bitcoin-backed loans are officially live for all eligible customers. Get started.

Story

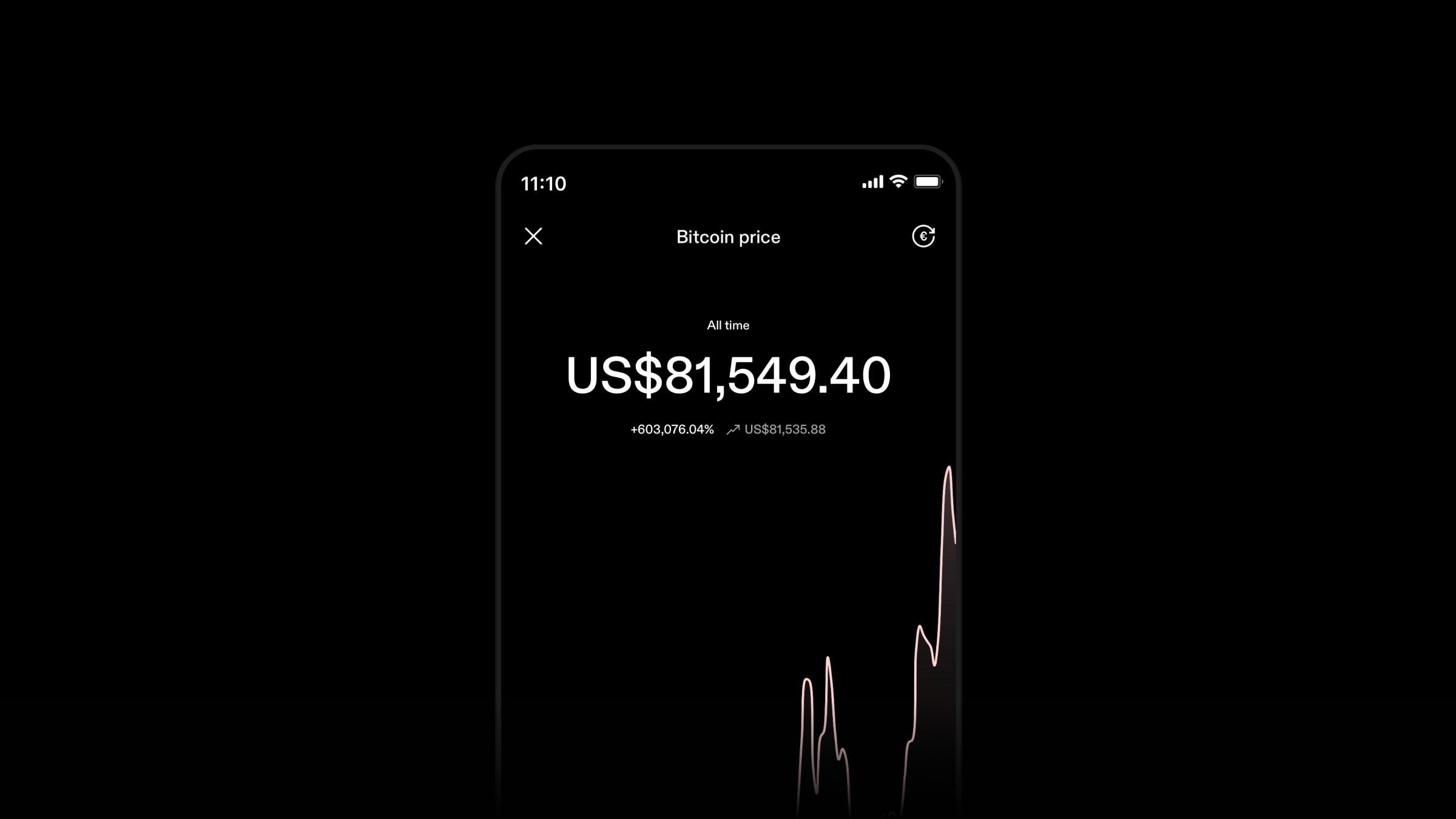

Bitcoin now represents roughly $1.8 trillion in global wealth making it the fifth largest asset in the world. That’s $1.8 trillion held by people who’ve chosen to store and grow their wealth in bitcoin.

Given its track record, it’s easy to see why. Over the past decade, bitcoin has outperformed every major asset class, delivering average annual returns of over 80%, far ahead of equities, real estate, and gold. Against the dollar, bitcoin has appreciated by more than 60% per year on average.

That kind of performance has shifted behavior. More people are choosing to hold rather than trade. As of April 2025, 63% of bitcoin hasn’t moved in over a year, a clear signal of long-term conviction. On Strike, that trend is even stronger: over 90% of bitcoin bought is withdrawn to cold storage.

Bitcoin is no longer a speculative bet. It’s a long-term store of value. But until now, accessing that value has meant selling, giving up future upside and triggering a taxable event that eats into your gains. For long-term holders, that tradeoff doesn’t make sense. They want access to the value they’ve built without giving up their bitcoin. That’s exactly what bitcoin-backed loans make possible. We’ve heard this feedback firsthand from our own customers.

A better way to borrow

Traditional borrowing has always relied on legacy systems like homeownership, credit scores, and relationships with banks. For decades, people have built wealth by borrowing against their homes. The property stays in their name, continues to appreciate, and the loan helps fund investments or major life expenses.

Bitcoin-backed loans offer a similar model but with more flexibility. You can borrow cash while using your bitcoin as collateral. No selling. No credit check or lengthy approval process. No giving up future upside. And if bitcoin continues to grow faster than your borrowing costs, your asset appreciates faster than your debt. In other words, the gains from holding bitcoin can more than offset the interest on your loan.

It’s a powerful shift. Financial tools that were once reserved for legacy assets are now available to anyone holding bitcoin.

Introducing Bitcoin-Backed Loans

Strike now offers bitcoin-backed loans to eligible customers in select U.S. states, giving you a simple way to unlock your bitcoin’s buying power without selling.

The experience is designed for Bitcoiners, fast, simple, and intuitive. Post your bitcoin as collateral, receive cash, repay with interest, and get your bitcoin back, all within the Strike app. Easily monitor your loan and manage your collateral every step of the way.

Whether you’re buying a home, investing in your business, or funding your next move, bitcoin-backed loans turn long-term holdings into real-world utility, without giving up your stack.

Why borrow against your bitcoin?

- Keep your bitcoin: Stay exposed to future upside while accessing cash today.

- Mitigate taxable impact: Bitcoin-backed loans typically aren't taxed, but situations like loan liquidations or repaying with bitcoin can trigger taxable events.

- No credit checks: Approval is based on your bitcoin collateral, not your credit score.

- Fast access to funds: No lengthy approval processes or appraisals.

Learn more about bitcoin-backed loans.

Unlock your bitcoin’s buying power

Borrow at market-leading terms

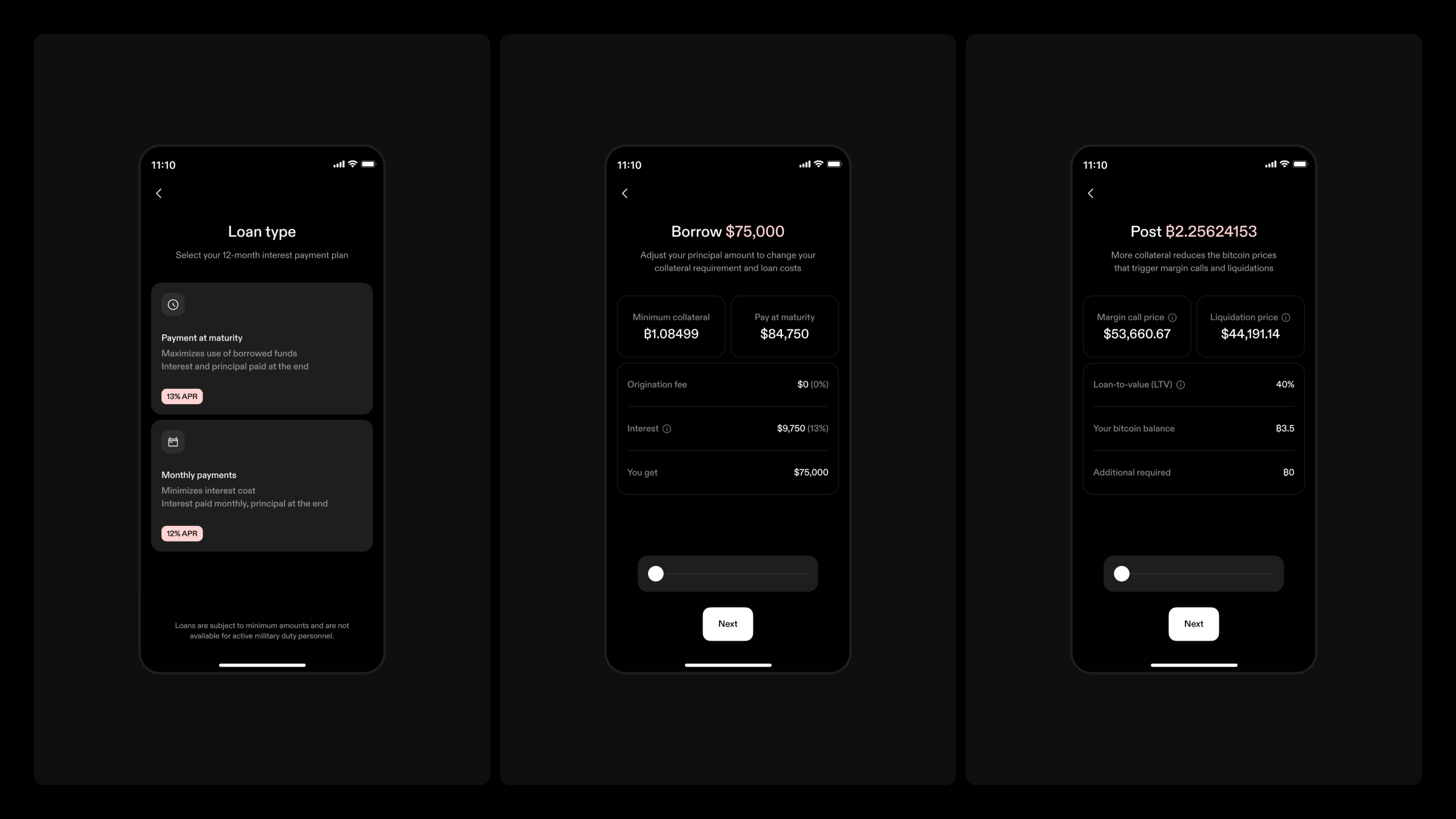

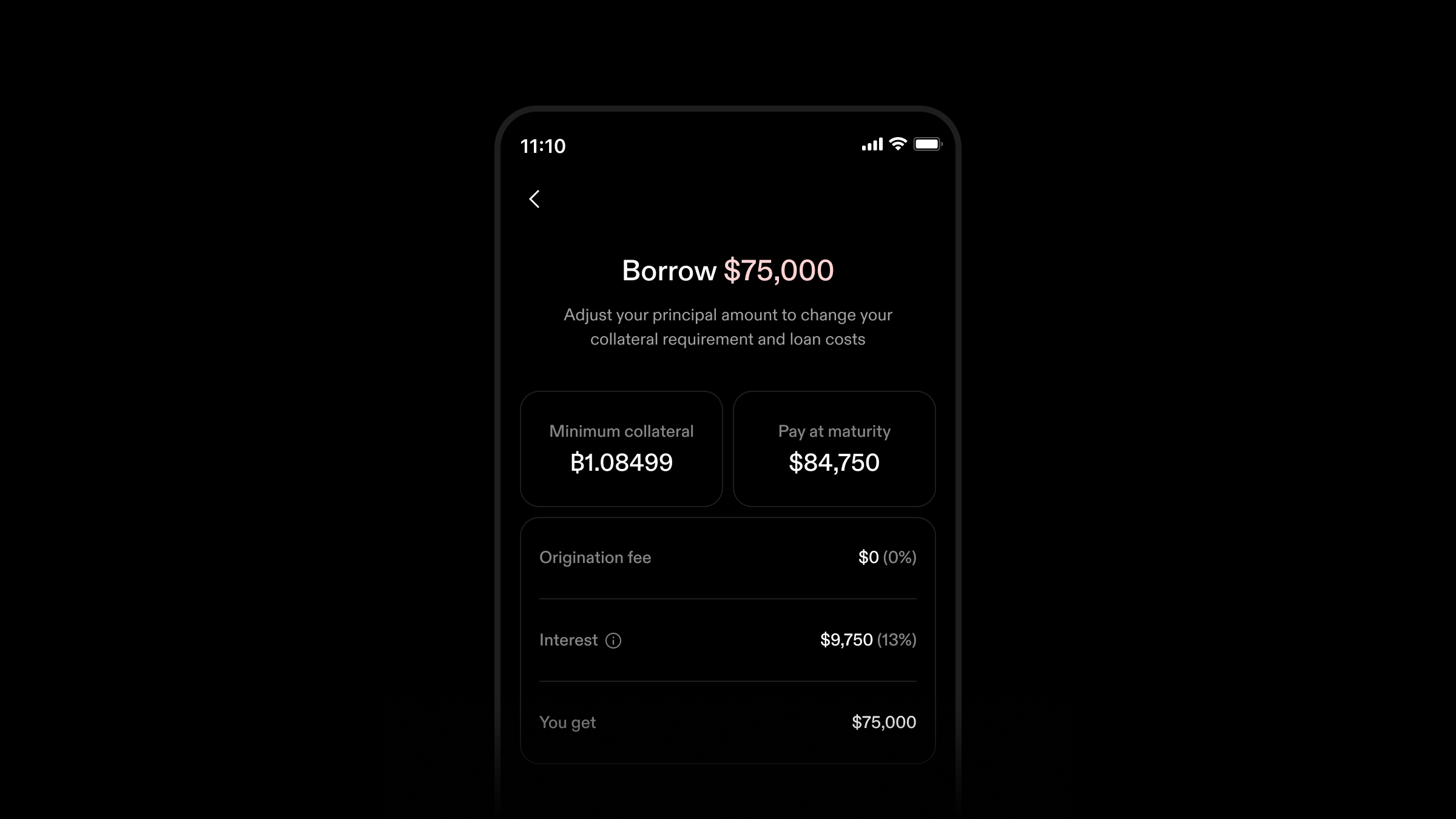

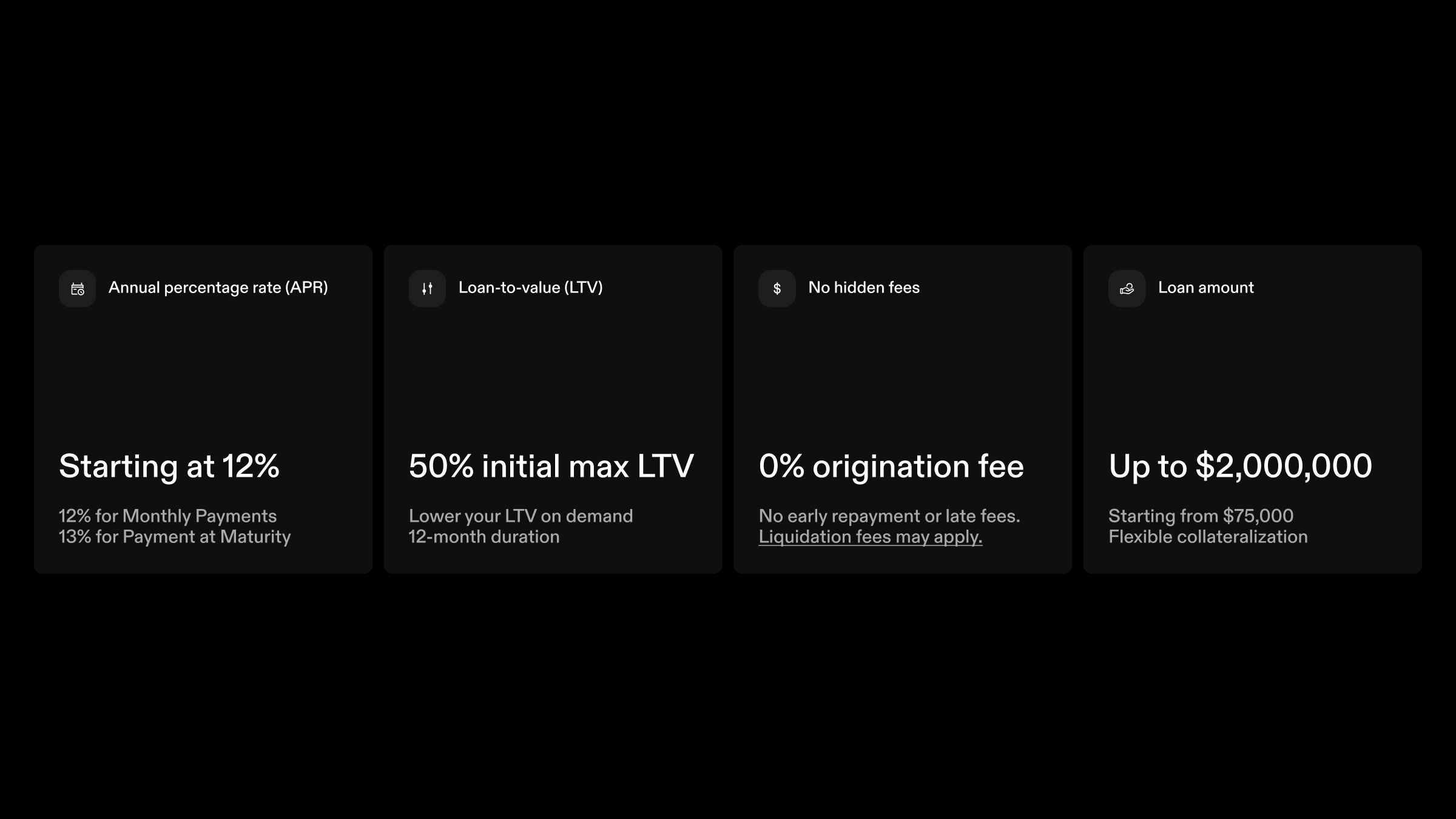

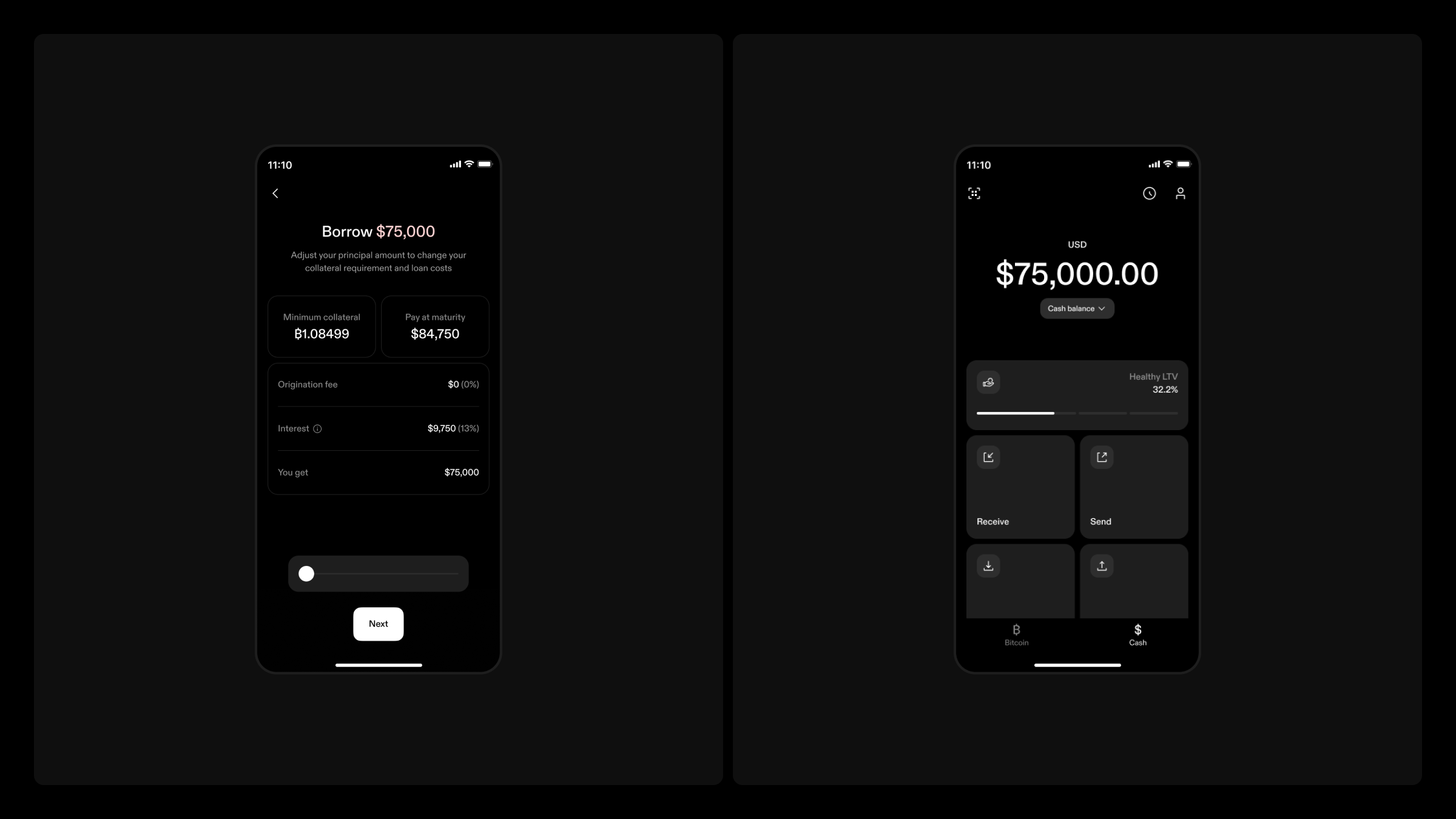

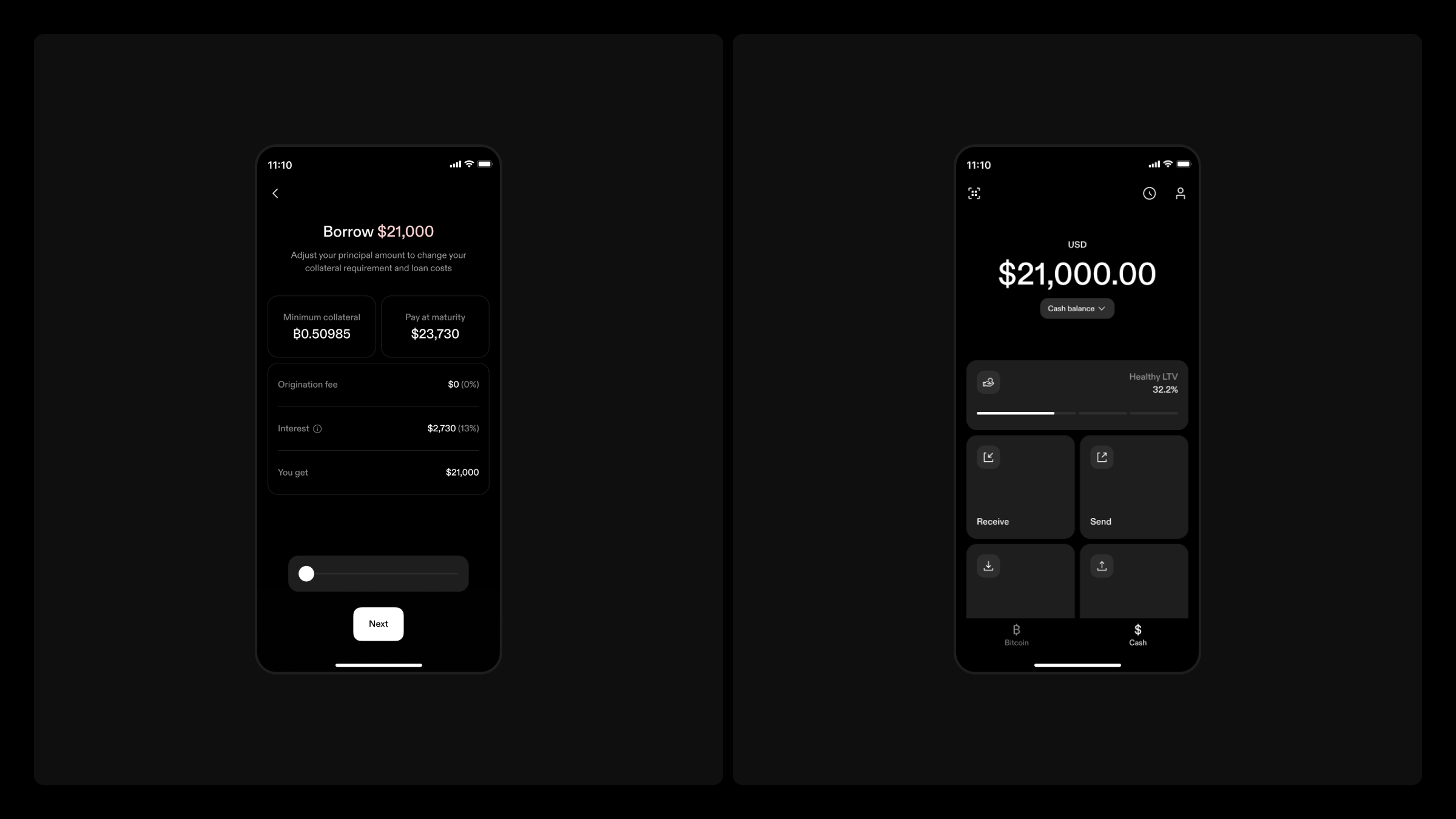

Strike offers bitcoin-backed loans from $75,000 to $2 million, starting at a 12% annual percentage rate (APR) for a 12-month term with a max initial loan-to-value (LTV) of 50%. There are no origination fees and no early repayment fees.

You can choose to pay interest monthly or at maturity, and add collateral anytime to lower your LTV. Everything is customizable inside the app. Learn more about our current loan rates, fees, and terms.

Check out Strike’s Loan Simulator towards the bottom of the page to model your options and pick what works best for you.

Bitcoin-backed loans are now rolling out with a $75,000 minimum. But this is just the beginning. We’re already working on lower rates, the ability to top up existing loans, proof-of-reserves lending, removing loan size limits, and expanding into new markets.

Open a loan in minutes

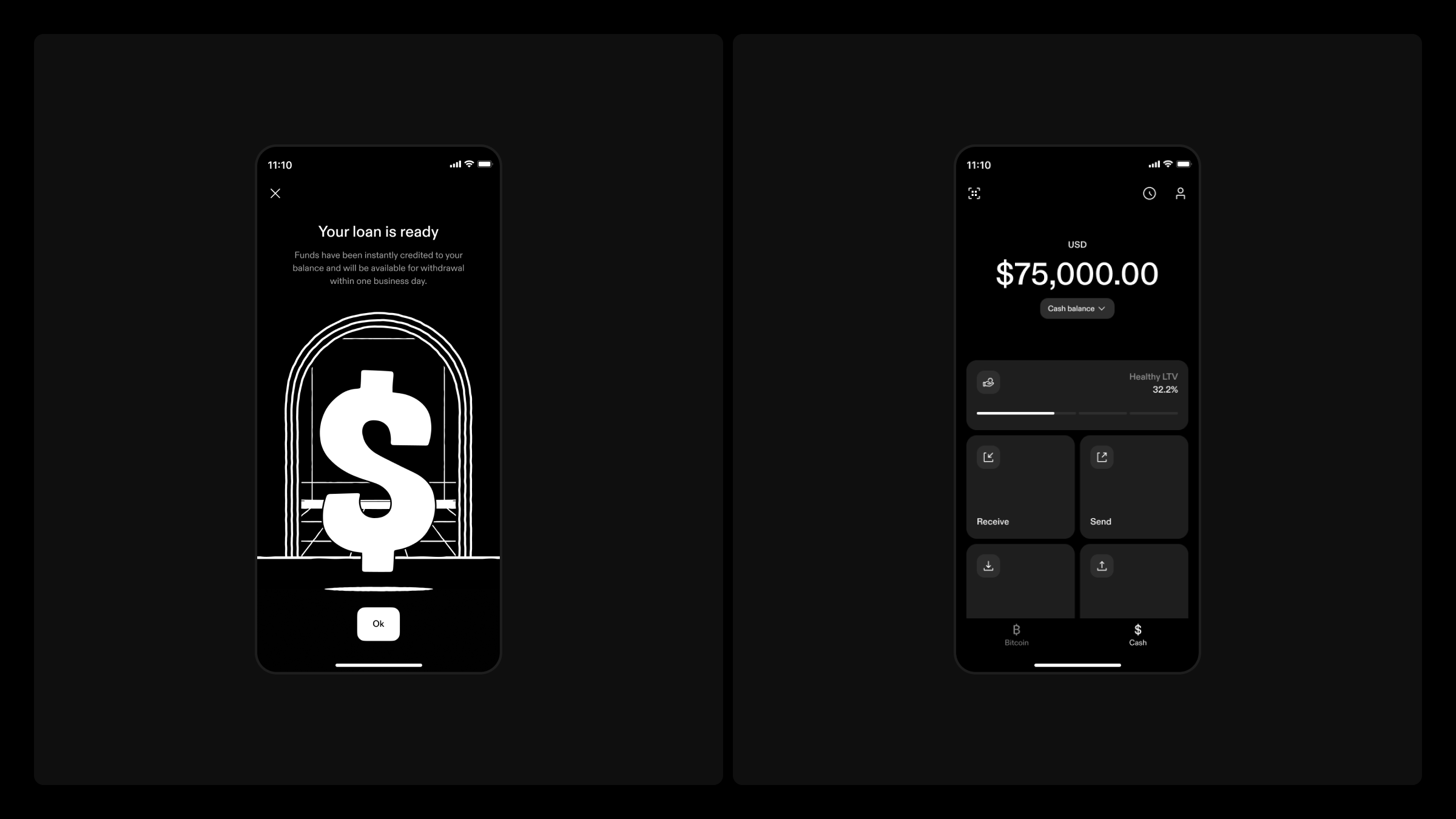

Opening a bitcoin-backed loan is fast and simple. Apply directly in the Strike app, select your terms, and get approved in minutes. Once approved, your cash is credited instantly and available to withdraw within one business day. Loans are not reported to credit agencies and do not affect your credit score.

How it works:

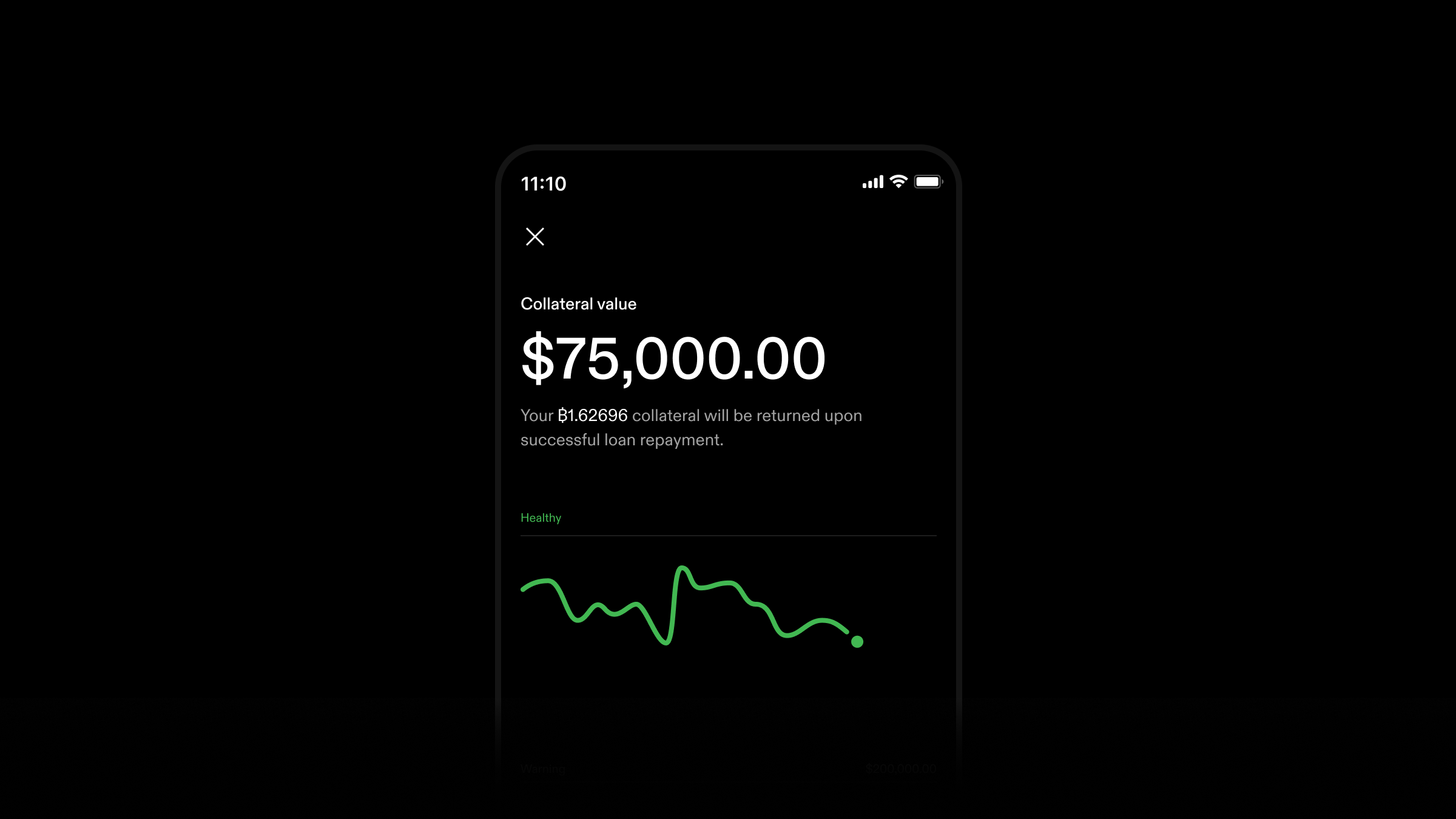

- Post bitcoin as collateral: Use your bitcoin as secure collateral for the loan.

- Receive cash: Cash is delivered to you and your loan begins accruing interest.

- Manage your loan: Track your loan’s health, manage payments, add collateral, or close-out your loan early, all from the Strike app.

- Repay your loan: Either at maturity or via monthly payments, you repay your loan with interest.

- Receive your collateral: Once fully repaid, your collateral is returned to you.

Learn more about how to open a bitcoin-backed loan.

Your bitcoin, securely held

When you open a loan, your bitcoin collateral is held by Strike or transferred to one of our trusted capital providers, where it is securely held and not re-hypothecated. This means your bitcoin collateral is never lent-out, shorted, or transferred to any other external third party. Learn more.

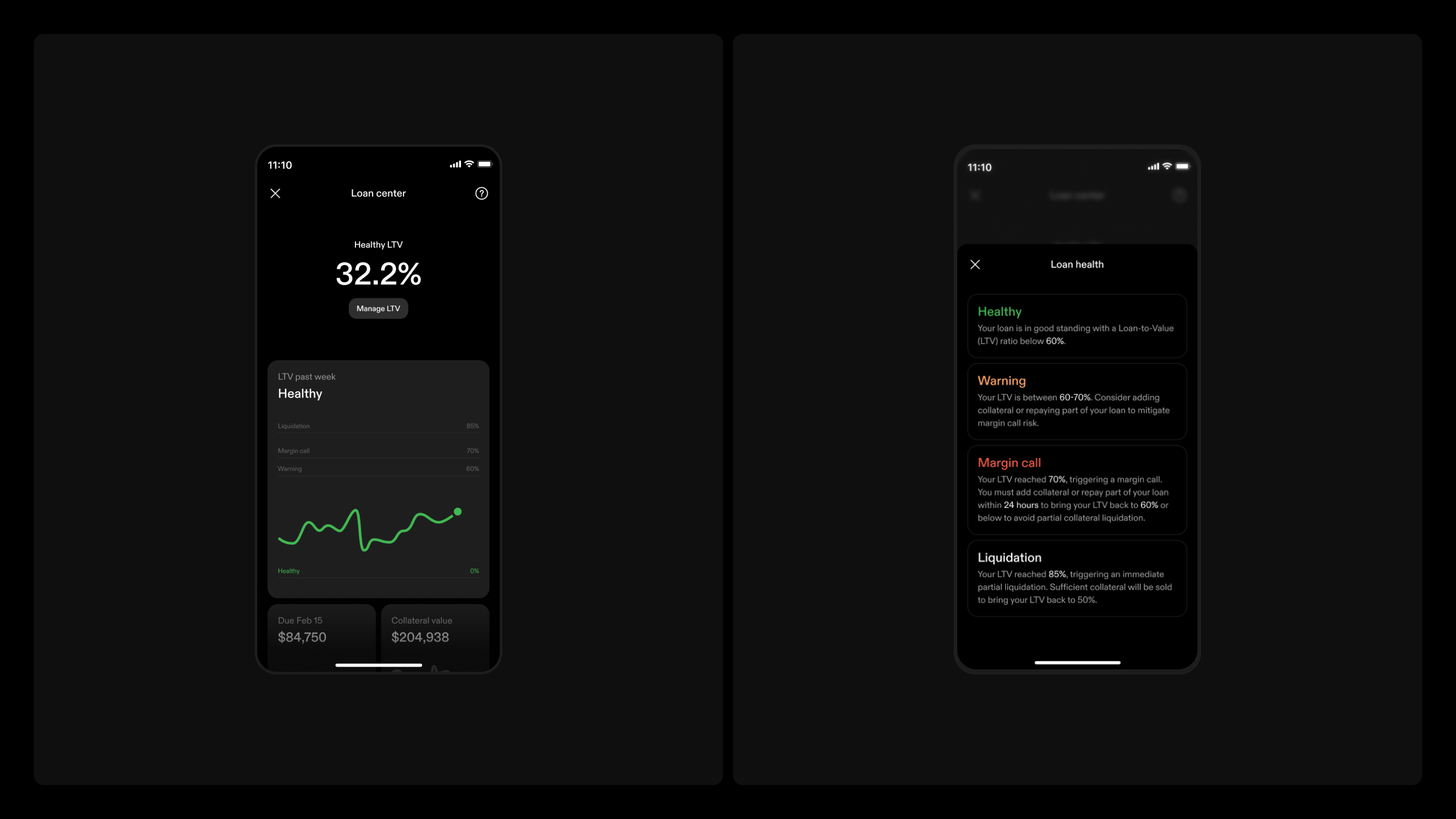

Monitor and manage with ease

Strike’s Loan Center puts you in control. Track your loan health in real time, receive alerts about your loan health, and get priority support, all from the Strike app. Our bitcoin-backed loans experience is designed for clarity, control, and peace of mind. Learn more about how to manage your loan in your Loan Center.

Stay invested in bitcoin’s future

Selling bitcoin means giving up long-term upside and potentially triggering a taxable event. Bitcoin-backed loans let you stay invested while unlocking the value you’ve built.

Whether you're putting a down payment on a home, investing in your business, or covering a major expense, bitcoin-backed loans give you the freedom to use your bitcoin without giving it up.

Get a bitcoin-backed loan

Bitcoin-backed loans are now available to all eligible customers in select U.S. states. If you're eligible, you’ll see the Bitcoin-backed loans card in your app’s Cash tab. Tap it to get started.

Not seeing the card yet? Make sure your app is updated and your account is fully verified. Get started.

Prior to opening a loan, check out our FAQs to familiarize yourself with how bitcoin-backed loans work, including the Loan-to-Value (LTV) ratio, how payments work, and margin calls and liquidations.

Additional resources can also be found in our Learn resource hub.

Bitcoin-backed loans for businesses

We’re excited to announce that we’re beginning to roll out bitcoin-backed loans for businesses over the coming weeks. For businesses, Strike offers bitcoin-backed loans from $10,000 to $2 million, starting at a 12% annual percentage rate (APR) for a 12-month term with a max initial loan-to-value (LTV) of 50%. There are no origination fees and no early repayment fees. Learn more.

Thanks

As bitcoin continues to grow into a global financial asset and more people build real wealth, it deserves financial tools built specifically for it that reflect how people actually use and hold bitcoin today.

At Strike, we’re focused on building that future with real financial tools that provide utility for bitcoiners. With the addition of bitcoin-backed loans, we now support spending, saving, getting paid, and borrowing all through bitcoin.

We wouldn’t be here without our customers. Thank you. Your conviction, your feedback, your belief in bitcoin, and in us, is what drives everything we do. We’re excited to continue this journey with you.

Until then. Much love.

Jack

––––

Updated on May 12, 2025, to reflect new information about our bitcoin-backed loan offering: Whether you’re opening a new loan or already have one, your bitcoin collateral is held with Strike or transferred to one of our trusted capital providers, where it is securely held and not re-hypothecated.

© 2025 NMLS ID 1902919 (Zap Solutions, Inc.)