What is the Bitcoin halving?

The automatic reduction in Bitcoin’s supply-issuance rate

The Bitcoin halving is the reduction of new bitcoin supply issuance by half, which automatically occurs every 210,000 blocks (roughly 4 years).

Bitcoin halvings are a key feature of Bitcoin’s supply schedule, which sets the timing and quantity of how bitcoin’s supply is issued into circulation.

Bitcoin’s supply is limited and follows a preprogrammed schedule. That supply schedule is encoded within the Bitcoin software, which means every computer running the software is actively enforcing the supply limits. With each block of transactions, a set amount of new bitcoin are issued into circulation, known as the “block subsidy”.

The subsidy amount was set at 50 bitcoin per block when Bitcoin was launched, and is set to automatically reduce by half every 210,000 blocks. This reduction is commonly called the “halving” or “halvening,” which is a decrease in the rate of new supply issuance – not a decrease in the supply itself.

This means that although the circulating supply of bitcoin grows over time, the rate of supply growth diminishes at a predictable pace. According to the supply schedule, after the 33rd halving cycle there will be no more bitcoin to be added and it will reach its terminal supply limit of 21 million bitcoin.

When does the Bitcoin halving occur?

Bitcoin halvings occur every 210,000 blocks, which means they are not actually based on time, but rather on a set number of blocks.

The Bitcoin software targets block times of 10 minutes by periodically adjusting the difficulty of bitcoin mining. When Bitcoin miners deploy more computational power (aka hashpower), they are able to mine blocks faster, which in turn increases the speed of bitcoin supply issuance. The Bitcoin software automatically compensates for this by adjusting the difficulty of mining (aka the “difficulty adjustment”) every 2,016 blocks, so that block times remain consistent regardless of the total computational power of global mining.

The result is that Bitcoin blocks typically occur on average every 10 minutes, but can occur faster or slower depending on mining activity. This means that the exact dates of future halvings are always projections.

| Halving cycle | Date | Block | Block subsidy | Supply at halving |

|---|---|---|---|---|

| Launch | January 3rd, 2009 | 0 | ₿50 | ₿0 |

| 1st halving | November 28, 2012 | 210,000 | ₿25 | ₿10,500,000 |

| 2nd halving | July 9, 2016 | 420,000 | ₿12.5 | ₿15,750,000 |

| 3rd halving | May 11, 2020 | 630,000 | ₿6.25 | ₿18,375,000 |

| 4th halving | April 19, 2024 | 840,000 | ₿3.125 | ₿19,687,500 |

| 5th halving | 2028 (projected) | 1,050,000 | ₿1.5625 | ₿20,343,750 |

| … | … | … | … | … |

| 33rd halving | 2140 (projected) | 6930000 | ₿0.00000001 | ₿20,999,999.9769 |

A more thorough breakdown of Bitcoin’s supply schedule can be viewed here.

Can the halving affect the price of bitcoin?

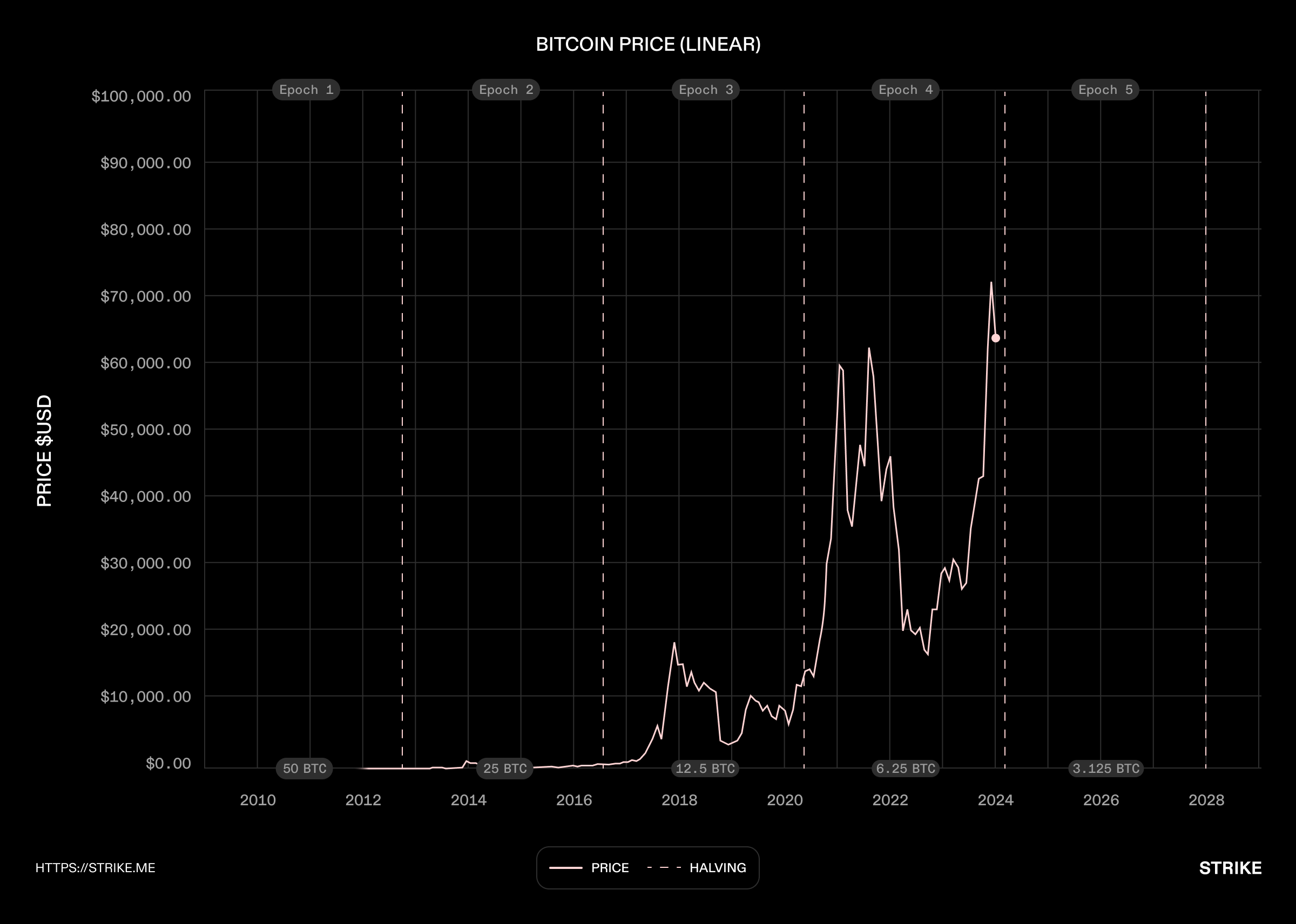

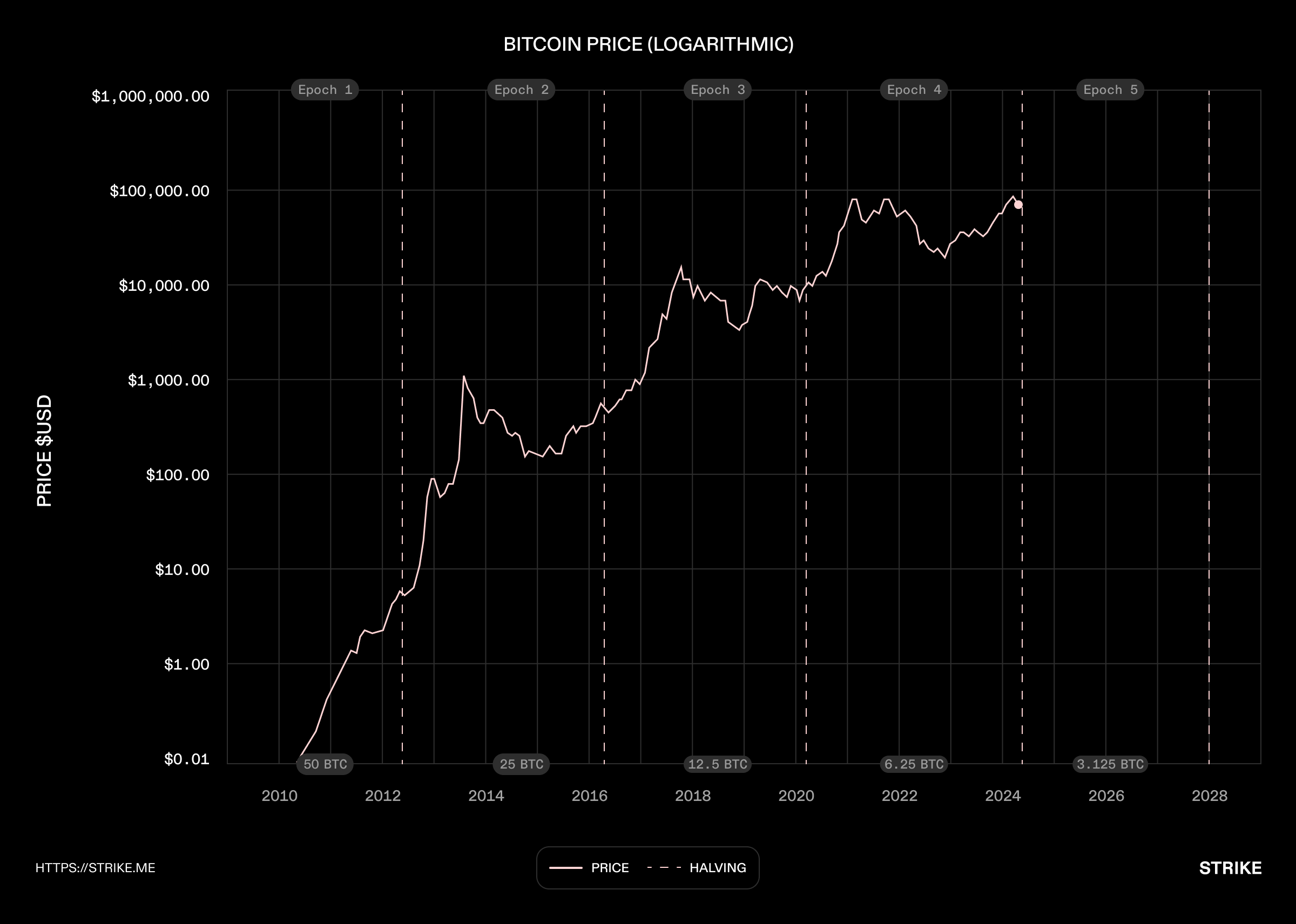

Bitcoin halvings have historically been followed by a rise in Bitcoin’s price over the next 12-18 months, often called a “bull run.” There is no guarantee that this trend will continue, but it can be worthwhile to examine the factors that have led to this trend.

First off, to examine the trend, it can be helpful to compare bitcoin’s price history in linear vs. logarithmic (log) scale charts:

- Linear scale: Linear-scale charts show price changes in absolute terms, with the y-axis in proportionally incremental units. A price move of $1,000 will appear the same across the entire chart. Linear scales are useful for shorter-term price analysis.

- Log scale: Log scale charts show price changes in percentage terms, with the y-axis in exponential scales. A price move from $100 to $200 (100% increase) will appear the same as a price move from $10,000 to $20,000 (100% increase). Log scale is useful for large price changes over a longer-time period.

Bitcoin is an asset that has seen exponential price increases over its history. A linear scale chart can make early price movements appear insignificant, even though they represent a doubling or tripling of the price in short time frames. To review bitcoin’s price moves over its multiple halvings, it can be more useful to view in log scale.

Viewing in log scale showcases a trend of 12-18 month post-halving bull runs, which are followed by retracements to a new higher baseline.

So why might a post-halving bull-run trend exist?

First and foremost, halvings affect miners. The halving is the reduction of newly issued bitcoin, which are awarded to miners. Miners have expenses, such as hardware, electricity, employees, and land, which are denominated in fiat terms (dollars, euros, yen, etc…). This means miners earn revenues in bitcoin, while incurring expenses in fiat.

Miners can therefore be viewed as a source of bitcoin-selling, since they must engage in ongoing selling of their bitcoin revenues to fund their operations. When the halving occurs, the amount of new bitcoin issued to miners is cut in half, reducing miners’ sell-pressure in the market.

It’s a supply-shock, although one that’s entirely foreseeable.

Because the price of bitcoin is determined by marginal buyers and sellers, a reduction in selling activity can cause an imbalance between supply and demand. Over time, this can lead to an increase in price as buy-pressure exceeds sell-pressure, bidding up the price until a new equilibrium is established.

In addition to affecting miners’ selling activity, the halving can also affect the perceptions and behaviors of buyers:

- Anticipatory buying: In anticipation of the reduced sell-pressure from miners, buyers may seek to buy more bitcoin to get ahead of market price movements.

- Publicity and hype: Bitcoin halvings are special events that occur only every 4 years, which can draw additional media attention. As more people learn about Bitcoin and its benefits, the number of potential buyers can increase.

- Historical precedence: Post-halving bull runs can become a self-fulfilling prophecy as previous halvings set expectations and change behaviors of market participants. Buyers may increase their buying and sellers may delay or reduce their selling, simply because they expect the price to rise in the months following a halving.

All that being said, it’s never certain whether a halving will be followed by a rise or fall in bitcoin’s price, or whether the price will remain unchanged. Each halving has occurred within different macroeconomic and market landscapes, including inflation rates, interest rates, global awareness, and different channels through which to buy bitcoin. All of these factors can affect buying and selling behavior.

© 2025 NMLS ID 1902919 (Zap Solutions, Inc.)